Concordian Economics: A non-Newtonian Construct by Carmine Gorga, Ph.D.

Concordian economics is a non-Newtonian construct because it does not respect the law of incompenetrability of bodies. As known since the theory was formulated by classical economists, economics is composed of three major elements: production (A), distribution (B), and consumption (C) of wealth. The meaning of these terms has varied over time.

In Concordian economics, production means production of real, physical wealth as well as services; distribution means distribution of value of ownership of rights over real and monetary wealth; consumption means expenditure of monetary wealth. Consumption as destruction of wealth in real terms is absorbed into the notion of net production.

As it can be seen, in addition to intangible services there are two terms in Concordian economics, money and ownership rights, which are not physical. They intermingle with the physical conception of real wealth. Hence, Concordian economics is a non-Newtonian construct.

Generally, mainstream economics is not faced with this Newtonian issue of incompenetrability of bodies because the nature of such real wealth as tables and chairs is made homogeneous by transforming it into the corresponding monetary value of tables and chairs. Quite apart from necessarily using monetary values, Concordian economics resolves the issue of non-homogeneity of real wealth with the assistance of such intellectual tools as labor-units, energy-units, or value-units. The issue is important because, if the meter were as flexible a unit of measurement as the dollar, we would never have been able to reach the moon and return so safely and effectively as we did.

(Continues after the jump)

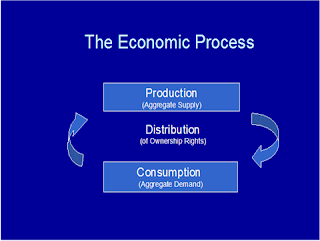

Concordian economics, in particular, is non-Newtonian because it is non-linear. Mainstream economists believe that there is first the production of items of real wealth, then their distribution, and then their consumption. Mainstream economics, in other words, is linear. Concordian economics is non-linear, because it observes that the three events occur at once. This characteristic is made clear in the following figure:

Figure 1 is a depiction of the economic system at one moment in time. It is better read if one restricts the observation of the economic system as if it were composed of only one person, in this fashion: I detach the apple from the tree (I produce the apple); I declare that it is mine (I distribute its ownership rights to myself); and I spend the apple (I consume it) either by eating it or by hoarding it or by exchanging it for a fish.

To obliterate the possibility of different instants, it is necessary to assume that I eat the apple while it is still on the tree. In general, the issue of time, which was solved in physics by Einstein with his conception of space-time, is solved in economics in a variety of ways. First, since economic theory is ahistorical, mainstream economics does not even consider the question of time. Second, since the demand/supply equation depicts synchronous events, time does not exist in mainstream economics. Third, the question of time is solved by establishing a unit of time—by convention, a year—long enough to cancel any discrepancy between the moment of production and the moment of consumption. Concordian economics wholly adopts these conventions.

Figure 1 is even better read when it is generalized in this fashion: the act of production is not completed until it is exchanged for an amount of money: this conception is especially necessary today when production occurs at the touch of a button and is limited mainly by the sale of the product in the market. Clearly, in a civilized society, for the exchange to occur, the producer must have ownership title to the goods and services produced and the consumer must have ownership title to the money spent.

Hence Figure 1 depicts the transfer of goods and services from producers to consumers and the transfer of financial instruments from consumers to producers. Figure 1 catches these events at the moment of the exchange.

Observed over time, the three elements of production, distribution, and consumption translate themselves into three trajectories. If there were a perfect correspondence among these phenomena, the three trajectories would overlap. Thus:

This is what mainstream economics analyzes. The three phenomena of economics, production, distribution, and consumption are kept in the following linear relationship: A → B → C, with the great variety of combinations and permutations in which these elements, jointly or separately, wholly or in part, can be combined and analyzed.

Instead, as observed in Figure 1, Concordian economics sets these elements in the form of the following equivalence relation: A = B = C. Thus the three terms are strictly and organically related to each other. Concordian economics observes that the three economic phenomena tend to separate themselves from each other. Hence, the trajectory of the distribution of wealth is by common understanding found to be rather static over time: Thus, at first approximation, it can be represented by a straight line. The trajectory of the monetary wealth, because of the relative ease of creation of monetary instruments, tends to be faster and broader than the trajectory of the real wealth. Essentially, the three events can be represented along these lines:

Figure 3 offers another indication that Concordian economics is non-Newtonian. The mathematics of Figure 3 is non-linear and the geometry is fractal. The mathematics of Concordian economics is available in a number of publications. The fractal geometry of Concordian economics is still largely in the cursor. The topic will have to be reserved for another time.

Carmine Gorga, PhD, a former Fulbright Scholar, is president of The Somist Institute. He is the author of The Economic Process: An Instantaneous Non-Newtonian Picture (University Press of America, 2002 and 2010) and various other publications.

To call this non-Newtonian is akin to biologists dividing animals into elephants and non-elephants.

ReplyDeleteAt least he didn't use "entropy". Maybe I'll have to buy his book to see that pleasure.

I recently bought the book; am reading it. Much good stuff but I must take issue with the sub-title. In my opinion, it's not 'non-Newtonian economics' but is, instead, merely a slightly different approach to the study of 'welfare economics'. So far, it has not faced the unwanted fact that Carlyle was quite correct when he took his lead from The Right Reverend Thomas R. Malthus and called economics "the dismal science". Economics, again in my opinion, must become a TRUE science and concern itself ONLY with 'who gets how much when there is not enough to go around'. Humanity's unbridled fecundity guarantees that there will never be enough for everybody. Basically, the dumb and the deluded are reproducing faster than the enlightened can win converts.

ReplyDeleteThe Association for the Advancement of non-Newtonian Economics (AAnNE)

ps: I did not originally plan/wish to be anonymous. It’s the only way I could figure out how to get my thoughts approved for publication.

DeleteRichard

e-mail: aanne@frontier.com